Opening a bank account in Kenya

Opening a bank account in Kenya -Are you planning to relocate to Kenya in the near future? Otherwise, you may want to consider opening a brand new bank account.

You’ll have to adapt to Kenyan banking and finance if you’re an immigrant. So many financial transactions and banking duties may now be done online.

Banking has become more accessible because to online banking. There’s less of a need to physically handle Kenyan Shilling notes in Kenya, where the use of mobile wallets and mobile money is commonplace.

There are a few things you need to do before you may open a bank account in Kenya.

Following are some details about:

- In Kenya, how do you open a bank account?

- Kenyans can now conduct financial transactions using mobile phones and the internet.

- An international bank account in Nairobi, Kenya

- Kenyan financial institutions

- Money transfer to Kenya

>>>Best Kenyan Banks for Students

How to open a bank account in Kenya | Opening a bank account in Kenya

In Kenya, there are 44 major banks. Around 30 locally-owned banks make up the majority of the country’s banking sector, which is controlled by seven tier one institutions. According on the bank you choose, the procedure of creating an account in Kenya varies.

It doesn’t matter where you live in Kenya; your ability to bank will be affected. If you are not a Kenyan citizen, the procedure will be different.

Do not fear! Please don’t worry about it; we’re here to help! Opening a bank account in Kenya.

When opening an individual bank account in Kenya, you may be required to submit the following documents to the major Kenyan banks like KCB or Equity Group Holdings:

- a government-issued ID such as a passport

- Submitted the required paperwork.

- an energy bill or a rental agreement showing your home address

- You’ll need at least one passport-sized photo of yourself.

- Residency verification (Kenyan residency card)

- Taxpayer Identification Number (PIN) issued by the Kenya Revenue Authority (KRA).

- Referral from a former or current employer (Character reference)

If you’re looking to create a bank account in a large bank like Stanbic Bank or any of the local banks, you’ll need these documents.

It’s important to know what to expect when applying for a bank account, and this list should help you get started.

By visiting the National Bank of Kenya’s website, you can find out more about the financial system in Kenya. Aside from normal banking services, NBK will explain how Kenyans save and invest their money.

Online and mobile banking in Kenya | Opening a bank account in Kenya

Banks all over the world are working hard to provide their customers with the most mobile and easy banking experience imaginable. Online and mobile banking are often given first consideration in this context. During the pandemic, it has been difficult to visit branches and conduct face-to-face meetings and exchanges. This has been especially critical.

With KCB’s iBank system, you may open an online banking account in a matter of minutes. In addition, you can use the KCB Mobile App to access your online banking account and perform traditional banking activities and administration.

When it comes to mobile money and finances, Kenya is at the top of the heap. In 2021, mobile money transactions increased by 52%, and there are now over 67 million mobile money accounts in the United States of America. For the time being, it’s the most accessible and convenient method of sending and receiving money for the majority of Kenyans. Companies like M-Pesa, Airtel, and Equitel, all of which are affiliated with Small World, provide mobile banking and mobile wallet service.

Opening a bank account in Kenya from abroad | Opening a bank account in Kenya

Bank accounts can be opened in Kenya by non-Kenyans. For the process to function, you usually need a Kenyan address or to have already lived in Kenya. This is due to the fact that many Kenyan banks require an address and proof of residency in order to open a bank account.

If you have a work/residence permit and a visa, you can normally begin the process of creating an account before you arrive in the country, however each bank is slightly different. Some banks, such as KCB, allow Kenyan natives and holders of Kenyan passports to open a bank account from outside the country.

Opening a bank account in Kenya, KCB’s Diaspora Current Account requires the following:

- A Genuine Kenyan Passport or Identification Document

- You must be a foreign national to apply.

- PIN certificate from KRA

- a certified copy of your current residence’s address

- Passport-sized color photo

- (A legally signed FATCA form is also required for US citizens.)

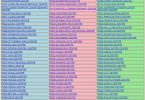

Banks in Kenya | Opening a bank account in Kenya

Now that you’ve learned how to open a bank account, it’s helpful to have a list of Kenyan banks to select from.

Small World has worked with some of Kenya’s largest and best banks, including the following:

- The KCB Bank (Kenya Commercial Bank is partnered with Small World)

- Bank of America Merrill Lynch

- Barclays Bank Kenya/Absa Bank Kenya PLC

- Bank of America

- The Diamond Trust Bank of Kenya.

- The equity holdings of Equity Group

- Bank of Kenya’s Co-operative Society

In addition to personal banking options, each of these institutions also provides a wide range of business and international banking options. Visit their websites to learn more about the various banks and to determine which one is the most convenient for you.

Bank in Kenya with a local or commercial bank, or even an international or specialist foreign or local bank; Small World can assist you with all of your international money transfer needs.